Private and institutional collecting

Structural changes that support art collecting

Sustained Economic Growth and Further Rmb Revaluation

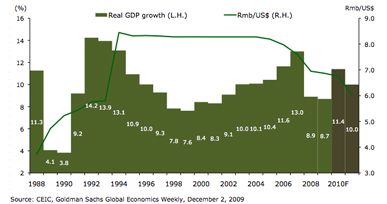

In the past 20 years, China's real GDP has expanded at an impressive average annual rate of 9.7%. Goldman Sachs forecasts that China's real GDP will continue to grow at 11.4% in 2010, followed by 10.0% in 2011, which is very impressive in view of marked slowdown in the rest of the world. The Chinese currency has steadily appreciated 20% since it's low in 1994, and under pressure from the US, China's biggest trading partner, the Rmb is likely to revalue further, which would be an added benefit to US$-based and other non-Rmb-based investors investing in Chinese Rmb-assets, including Chinese art.

Accelerating Private Wealth Creation

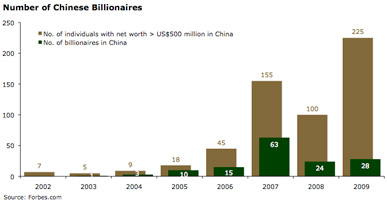

According to Forbes's China Rich List in 2002 there was no billionaire in China and only 7 individuals had a net worth greater than US$500 million. Despite a collapse in value since the financial crisis in 2008, there were 225 Chinese individuals on Forbes China Rich List in 2009 with a net worth greater than US$500 million, up from 155 in 2007 and 100 in 2008, though the number of billionaires has dropped to 28, from the peak of 63 in 2007. According to Forbes, the richest person in China had a net worth of US$5.8 billion in 2009, down from the peak in 2007 when the richest person had a net worth of US$16 billion. Forbes's China 400 Richest in 2009 were worth a record US$314 billion, about one-fourth the total net worth of their American counterparts. These numbers are modest given the size of the Chinese economy—the World Bank estimates a GDP of US$7.9 trillion in 2008 measured by Purchasing Power Parity, behind the Eurozone at US$10.9 trillion and the United States at US$14.2 trillion—and its rapid pace of expansion, particularly in the private sector.

|  |